- Atlanta Public Schools

- What is a TAD?

-

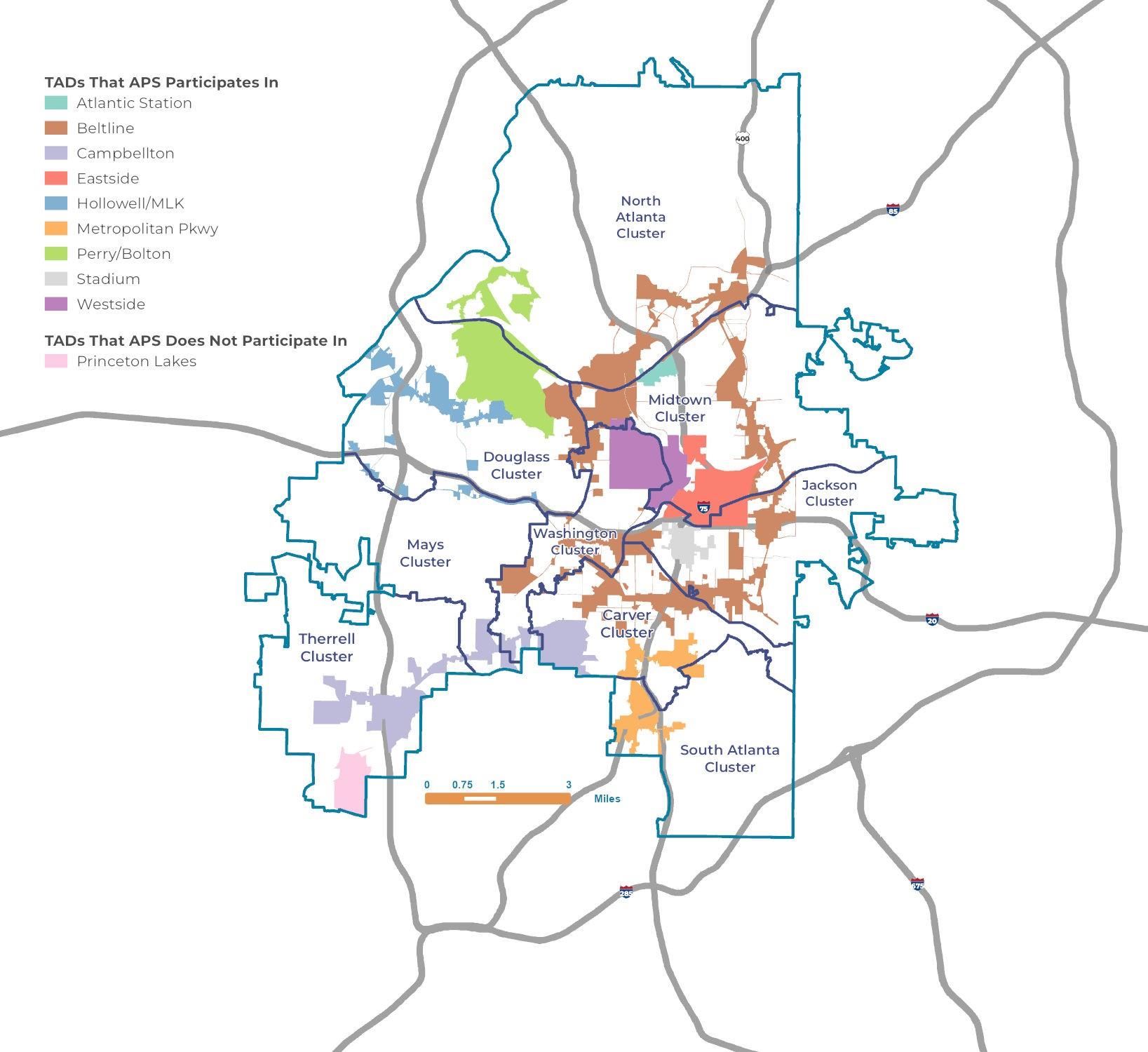

Tax Allocation Districts (or TADs) are intended to spark development in areas of a city that are otherwise economically depressed or blighted, and would not be developed but for the designation of a TAD.

When a TAD is established in our city, Atlanta Public Schools, the City of Atlanta and the Fulton County Government can each decide if that entity will participate. Participation means contributing any new taxes generated by the new development back into the TAD to pay off the debt.

APS has contributed more to the nine TADs we have participated in than the City of Atlanta and Fulton County combined – 52% of actual tax collections – making up the majority of TAD funding. APS has been a good partner in the redevelopment of Atlanta, and by 2050 will have contributed a total of approximately $2.4 billion of tax revenue for redevelopment purposes instead of educational purposes.

Once a TAD is established, APS does not get to decide how those dollars get managed. Over the years those dollars have not been managed well. We must be thoughtful and cautious about the current money pressures put on the district. We are currently working to fix or renegotiate the current TADs to reduce the burden on tax payers.

-

Since 1999, Atlanta Public Schools has contributed $765 million

in taxes generated from our millage to redevelopment in the city.